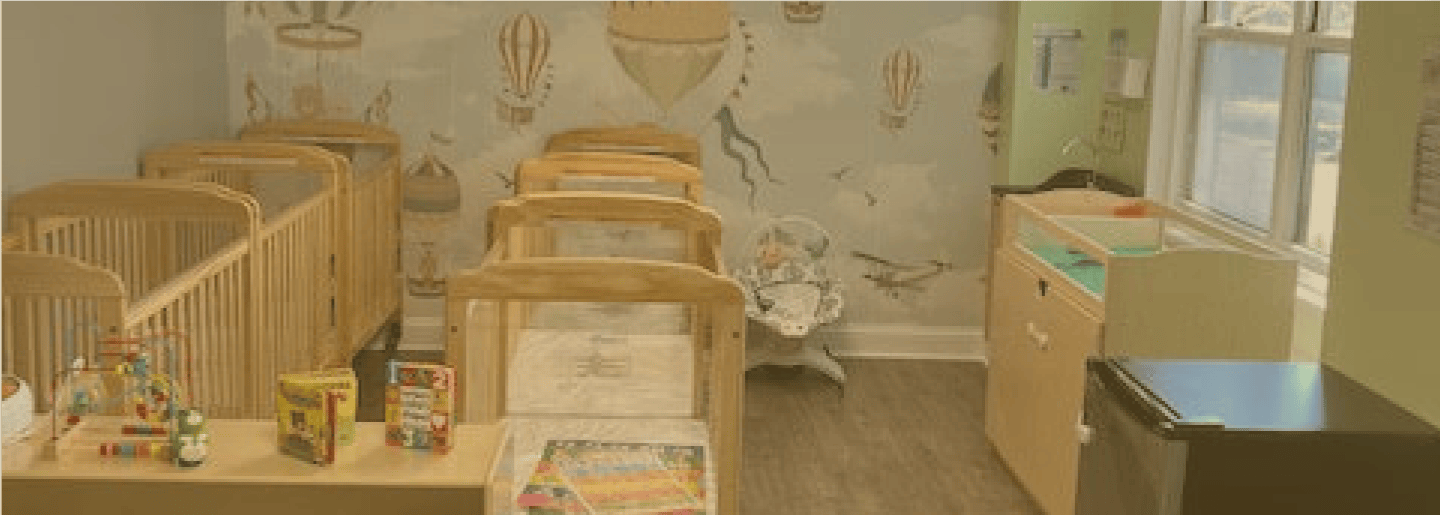

Helping Families Access Quality & Affordable Childcare

At Growing Minds Daycare & Learning Center in Stamford, we understand that balancing the rising cost of living with high-quality child care can be overwhelming. That’s why we’re committed to helping families navigate child care assistance programs in Connecticut, including state-funded options, subsidies, and federal tax benefits.

Whether you're searching for CT daycare assistance, exploring low-income daycare programs, or wondering what kind of support is available for your family — we’re here to guide you.

Connecticut Office of Early Childhood (OEC) Programs

The Connecticut OEC provides additional resources to support families from birth through age 5, including:

Publicly funded preschool & early learning programs

Head Start and Early Head Start

Guidance on applying for child care assistance & subsidies

Child Care and Development Fund (CCDF)

The federal CCDF program offers financial aid for childcare to low-income families engaged in work or educational programs. This initiative also seeks to enhance the overall quality of childcare. For more information, visit the Connecticut Office of Early Childhood.

Connecticut’s Free Child Care Referral Service

2-1-1 Child Care is a free and confidential service that helps Connecticut families find local licensed child care providers, subsidy programs, and community resources.

Here’s how 2-1-1 Child Care can help you:

Search for nearby licensed child care programs like Growing Minds

Get help understanding child care assistance eligibility

Speak with trained referral specialists who guide you step-by-step

Available in multiple languages, including Spanish and Creole

Connecticut Care 4 Kids Program

Care 4 Kids is a state-funded child care assistance program that helps eligible low- to moderate-income families pay for child care while they work, attend school, or participate in approved training programs.

Available to families in Stamford and statewide

Families can choose their own licensed provider (like Growing Minds!)

Helps cover a portion of tuition based on income and family size

Federal Tax Credits & FSA Childcare Accounts (2025 Update)

Child Tax Credit (CTC)

Up to $2,000 per qualifying child, with $1,700 refundable. This credit can help offset child care and other child-related expenses. For eligibility details, visit the IRS Child Tax Credit page.

Dependent Care FSA (Flexible Spending Account)

In 2025, you can set aside up to $5,000 per household tax-free to cover eligible child care expenses through your employer’s Dependent Care FSA. This includes daycare tuition at Growing Minds!

Child & Dependent Care Tax Credit

Receive up to 35% of qualifying childcare expenses—up to $3,000 per child or $6,000 per family. Learn more about Affordable Care Act tax provisions for individuals.

Earned Income Tax Credit (EITC)

Refundable credit up to $7,830 for families with 3+ children (2025 amount). Eligibility depends on income and number of children. More information available at the IRS EITC page.

Learn More About Child Care Subsidies in Connecticut

We understand that navigating the world of child care subsidies can be overwhelming. To assist you further, we've compiled a list of resources where you can find more information about child care subsidies in Connecticut:

Care 4 Kids Program - Connecticut

2-1-1 Child Care - Connecticut

Office of Early Childhood (OEC) Programs - Connecticut

Child Care and Development Fund (CCDF) - Nationwide

Head Start and Early Head Start - Nationwide

Child and Dependent Care Tax Credit - Nationwide

Schedule Tour